Conditional loan approval is records from a lender proclaiming that your own mortgage app could be approved just after conference particular factors. It is a step within the underwriting, constantly anywhere between preapproval being cleaned to shut.

Secret Takeaways

- Conditional mortgage recognition try an announcement off a loan provider that a great financial will be acknowledged immediately following appointment a couple of requirements.

- The new conditional acceptance cannot ensure a home loan.

- You will need to meet up with the criteria place of the underwriter and have them analyzed before you can romantic.

Just how Conditional Financing Approval Really works

with the home-to get hunt. Yet discover an even finest reputation to settle because a borrower once you go into the market, which is conditional recognition.

A conditional loan recognition functions much like good preapproval for the a mortgage; however, its in addition to this into borrower. An enthusiastic underwriter evaluations all the mortgage papers ahead of delivering an applicant an effective conditional loan recognition. This deal even more lbs, showing that borrower was further collectively regarding mortgage approval techniques.

You are going to discover conditional recognition due to a written declaration on home loan company. It says that lender is satisfied with your application and will accept the loan for individuals who fulfill certain requirements. These could become:

- Confirming a job

- Supplying so much more financial comments

- Distribution a present page

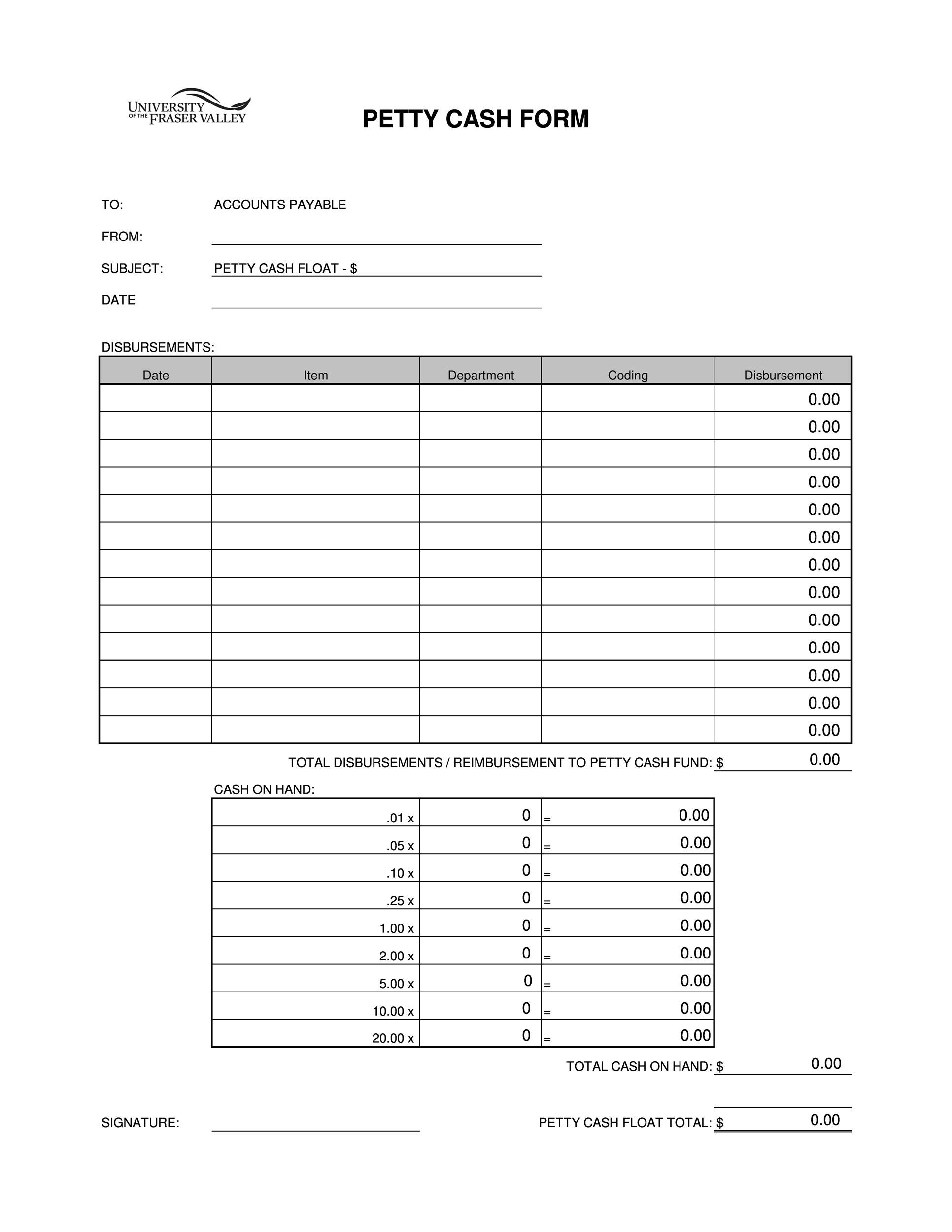

- Detailing present, higher withdrawals out of your financial

- Providing a home appraisal

It is important to keep in mind that finding conditional financing recognition doesn’t imply you might be guaranteed a loan. As an alternative, they claims that you will get the mortgage for those who supply called for affairs assuming those things receive the underwriter’s acceptance-increased exposure of the fresh in the event that. It’s essential not to have one thing significant change in your financial state in this techniques, because the that will result in a denial.

Acquiring conditional acceptance sets your when you look at the an excellent place as an enthusiastic interested buyer. It shows that you complete their diligence add financial records, also it offers the supplier trust that you will be an excellent applicant. Conditional mortgage approvals as well as help automate the closing techniques; you might be already deep into financial recognition by the time youre inside the transformation talks.

New construction often deems conditional approvals must move forward. A builder wishes the brand new lender’s confirmation that you’re approved through to meeting certain items. This provides you with a whole lot more rely on the build have a tendency to advances, that is essential a company when acknowledging a job.

Example of Conditional Mortgage Acceptance

Any real estate agent will tell you to buy around for a mortgage before you can seek property, and that’s a critical first rung on the ladder. You have to know exactly how much you may be accepted getting to create an authentic homebuying funds and you may guide your pursuit. The various degrees of financial approval you’ll deal with within the techniques is:

- Prequalification: The customer brings projected numbers which will be defined as a person who could possibly get meet the requirements.

After you have identified a lender you’d like to move ahead which have, you should promote normally records as you are able to. Title of online game at this stage is certian over and you will past in what you could potentially have to respond to most of the concerns. In addition, you can say the financial institution you need a good conditional loan recognition, after you’ve reach you to step.

The fresh new underwriter’s main tasks are to assess your ability to settle that loan. Be prepared because of the collecting widely known affairs up front of application. They truly are W-2s, financial statements, income tax productivity, verification out of a position, and you may characters explaining any higher purchases on the savings account.

Now will come the hard part: waiting around for the underwriter to review your application to discover if or not you are conditionally recognized. In this case, might discovered an announcement which have conditional approval, that you next may use for the conversation that have family sellers.

At the same time, you ought to move on to check the packages causing your own conditional financing approval that one may. Complete facts you have readily available or may quickly, for example money confirmation otherwise emails out of external activities. Stay in constant experience of the bank and tell them of timelines towards the such things as household appraisals, that’ll take see page longer to gather.

An effective conditional mortgage acceptance places your in the a better to buy reputation and you can will not simply take more hours otherwise energy. You will have to submit records and meet the underwriter’s criteria at some stage in the mortgage process. Initiate early and you will get into because the a more pretty sure homebuyer.

Faqs (FAQs)

That loan are refuted just after conditional approval for a couple reasons, so you must not take this step because a pledge. Including, you may not enjoys came across new deadline to submit more records. The fresh underwriter can be struggling to verify your information predicated on their distribution. You have taken on obligations, or something like that has come away concerning family you happen to be focusing on, such as for example a recently available lien.

Just how long after conditional recognition try last recognition?

The time ranging from conditional approval and you will final acceptance might be everywhere from a short while for some months. There’s no lay timeline, but you can service a quicker procedure by the communicating certainly having the lending company and you will supplying needed factors Asap.

What is the difference in preapproval and you will conditional recognition?

Preapproval happens when the financial institution verifies your credit rating and you may background without having any underwriter’s wedding. Which have conditional acceptance, this new underwriter possess assessed newest data files and you will deems your a great applicant, immediately following specific standards try came across. Conditional recognition sells a whole lot more validity, because individual that tend to agree or refute your application try fulfilled to date.