FHA financing laws and regulations need an appraisal of the home shielded from the the borrowed funds whether or not it is an existing build domestic or if you generate your self house having fun with a great One-Day Romantic loan.

if the FHA appraiser discovers something that does not satisfy local building password, or if there is certainly a destroy exposed inside the appraisal (these are simply a couple of samples of exactly what might happen at appraisal day towards an alternate build home) the individuals facts need to be fixed.

HUD 4000.step 1, brand new FHA Single-Family home Financing Manual, shows the lender that in the event the newest assessment shows things which do not meet the FHA minimal assets practical, brand new Appraiser must report the fresh repairs must improve Property comply, offer a projected cost to take care of, give detailed images, and you will condition brand new appraisal to your needed repairs.

FHA Mortgage Appraisal Requirements: Repairs

But one to projected cost to correct the problems must also meet FHA direction. It is, but they are not restricted so you can, standards for the next:

If compliance can just only become affected of the big repairs or adjustments, brand new Appraiser need report most of the readily observable assets deficiencies, also one desperate situations found starting the research on it within the end of one’s appraisal, in revealing mode.

- maintain the safeguards, protection and soundness of the home;

- uphold the proceeded marketability of the property; and you can

- include the and you may safety of occupants.

The fresh new loans in Orrville construction house aren’t 100% defect-100 % free 100% of the time. Consumers must not imagine a different build home is finest, and it’s really crucial that you enjoy the need for a lot more conformity monitors and other costs about new appraisal when changes are expected.

You do not indeed purchase anything (if you have no importance of a compliance review, like, whatsoever) however, that have that money and if will likely be an enormous assist after in the loan techniques.

Such fund and additionally go-by next brands: step 1 X Romantic, Single-Intimate Financing otherwise OTC Mortgage. Such loan makes it possible for one to finance the purchase of residential property in addition to the build of the home. You may use house which you individual free and clear otherwise possess a preexisting home loan.

We have complete detailed research on the FHA (Government Homes Management), this new Virtual assistant (Service out-of Pros Circumstances) together with USDA (United states Service away from Farming) One-Big date Intimate Structure loan apps. I have spoken straight to authorized lenders one to originate this type of residential loan sizes in the most common says each team possess supplied united states the rules for their items. We are able to link you having real estate loan officials who do work to own lenders you to understand tool well and possess continuously offered quality solution. If you are looking getting contacted to a single registered construction financial towards you, excite posting solutions into issues below. All the info is managed in complete confidence.

OneTimeClose brings guidance and you may links users to help you qualified One to-Big date Romantic loan providers as a way to boost sense about this loan equipment and help customers found high quality services. We are really not purchased endorsing or recommending lenders otherwise loan originators plus don’t otherwise take advantage of this. People will be buy home loan features and you will contrast their options in advance of agreeing to help you just do it.

Please note that investor guidelines for the FHA, VA and USDA One-Time Close Construction Program only allows for single family dwellings (1 unit) and NOT for multi-family units (no duplexes, triplexes or fourplexes). You CANNOT act as your own general contractor (Builder) / not available in all States.

At exactly the same time, that is a partial variety of another house/strengthening appearances which aren’t greet not as much as this type of apps: Equipment Residential property, Barndominiums, Cottage or Bamboo Land, Distribution Container Home, Dome Residential property, Bermed Environment-Protected Belongings, Stilt Residential property, Solar (only) otherwise Breeze Powered (only) Residential property, Little Home, Carriage House, Attachment House Systems and A great-Presented Homes.

The email in order to authorizes Onetimeclose to share with you your advice with a home loan structure lender signed up near you to make contact with your.

- Send very first and you may past label, e-post target, and make contact with telephone number.

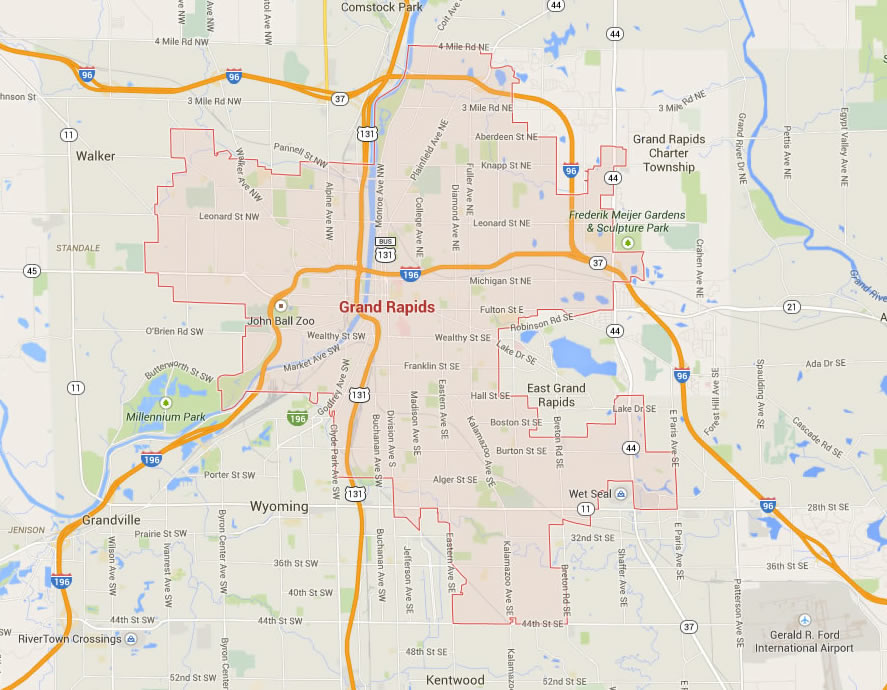

- Inform us the town and condition of your own proposed possessions.

- Inform us the and you may/or even the Co-borrower’s credit reputation: Higher level (680+), Good (640-679), Reasonable (620-639) otherwise Terrible- (Below 620). 620 is the lowest being qualified credit history because of it product.

- Could you be or your lady (Co-borrower) qualified pros? If the sometimes people qualify veteran’s, off costs as little as $ount your debt-to-money proportion Virtual assistant enable there are not any limitation loan wide variety as per Va guidelines. Really loan providers is certainly going up to $1,000,000 and you will feedback higher financing numbers towards the an instance because of the case base. Otherwise a qualified experienced, this new FHA down-payment are step three.5% as much as the new maximumFHA lending limitfor the state.

Bruce Reichstein has invested more than 3 decades as a talented FHA and Virtual assistant mortgage mortgage banker and you may underwriter where he was guilty of money Billions for the authorities recognized mortgages. They are new Dealing with Publisher to possess FHANewsblog where the guy educates property owners for the certain direction getting obtaining FHA secured mortgage brokers.

Archives

- 2024

About FHANewsBlog FHANewsBlog was launched this season from the experienced home loan positives attempting to inform homebuyers concerning the recommendations to possess FHA covered mortgage loans. Popular FHA topics become borrowing from the bank requirements, FHA loan restrictions, mortgage insurance fees, closing costs and even more. This new experts wrote tens of thousands of blogs certain so you can FHA mortgages and also the site possess considerably enhanced readership historically and you will is known for their FHA News and Feedback.

The Virtual assistant One-Date Close are a 30-year mortgage accessible to veteran borrowers. Borrowing from the bank guidelines are prepared by the lender, normally which have an effective 620 minimum credit score demands.